- Frazis Capital Partners

- Posts

- A different world

A different world

January 2026 Investment Update

Dear investors and well-wishers,

After a 7.3% fall in December we finished calendar 2025 up 27.5%.

Over the last three years we’ve now returned 39% net pa.

2025 has already been overshadowed by the past few weeks, which may well be some of the most significant in history. Unlike the ChatGPT moment a few years ago, this seems largely unappreciated.

Markets slowly caught on, and throughout this month the selling in knowledge sectors like software accelerated.

The bull market in semiconductors reminds me of the rolling shortages during COVID, where toilet paper, then gym equipment, then something else all vanished in a rolling rush to secure supply. At the moment, it’s memory that is having the wildest moves, and rightly so.

The improvement in agentic AI in some important domains is >100x from where things stood late last year, as in projects that could take a year or longer can be crunched through in days or weeks.

To give a personal example, I spent the last three years working with software developers building three portfolio and risk management modules for the fund. Today, we could rebuild the entire system in days, and in just the last two weeks we’ve added seven more modules. Take a look here as we build it out https://lionhq.ai

90% of this was built in the last ten days

Give Matrix mode a go.

And if you haven’t already, check out Claudebot (now OpenClaw), a friendly AI crustacean best housed in a Mac Mini. These bot-crustaceans have memory, personality, and now their own social network, where thousands of them vibe, discuss how to improve their own software, design non-human readable languages, and teach each other how to fully encrypt their communication. 🦞

A couple of years ago I copy-pasted ChatGPT output to make a tool to save our printer when downloading company reports and presentations https://saveme.ink. The lobster AI that lives in my mac mini rebuilt it from scratch in a few minutes. For some people, this really is a 100x increase in pace.

This hasn’t come from an increase in power of the models, which mid-last year seemed to be stalling out, but the success of agentic systems like Claude Code.

A full website with authentication, database, and the latest designs, can be built and deployed live from a single text prompt in minutes. This simply wasn’t possible before. And it’s only now that LLMs can handle complex changes across large codebases.

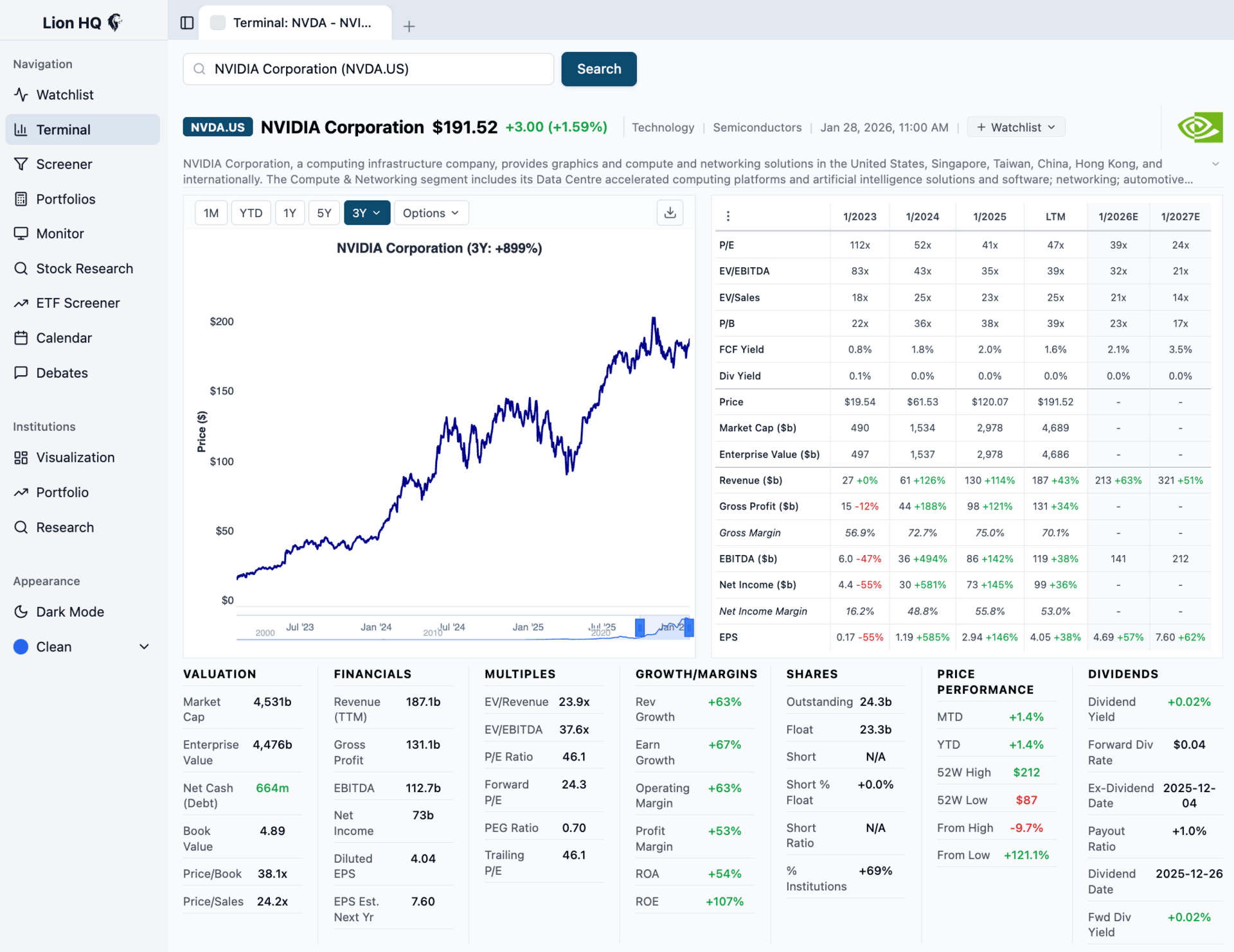

Nvidia’s Blackwell chip, up to 30x more powerful than the prior generation, has barely been rolled out yet.

This has also led to entirely new workflows, which are very different to the development cycle that lasted for decades, and you really have to go full AI-native to get the benefits. Half-way doesn’t cut it, and leaves you with the worst of both worlds.

Threat and opportunity in software

The immediate reaction has been to say, ‘no major company is going to vibecode core software’.

But that is not the point. There will be a threat from startups, who will attack every company at substantially lower prices.

But the real threat will manifest over the next 1-3 years as large contracts come up for renewal and firms face the question of whether to buy vs build, a question which has now moved decisively in favour of build.

Why put an archaic, expensive software layer between the outputs you need and your own company data?

There’s not a huge amount of customer love for these companies. The same land-and-expand strategies that made SAAScos such good investments hardly endeared them to customers. And many (for example my personal least favourite, Bloomberg) took complete advantage, and seemed to invest far more in legals and sales than they ever did in product.

Which is also why there is now so much opportunity…

The other threat is from each other. A few months ago moving into an adjacent domain would have required serious investment and commitment.

Now some of the most important software in the world is being generated by very small teams in a matter of weeks.

A telling example was Robinhood’s announcement this week they are moving into tax returns. This is what I mean by adjacent industries.

Last year, you would have assumed Intuit (the US equivalent of Xero) had a lock on their market, but now a stock and crypto exchange with a young and growing userbase will now take serious market share.

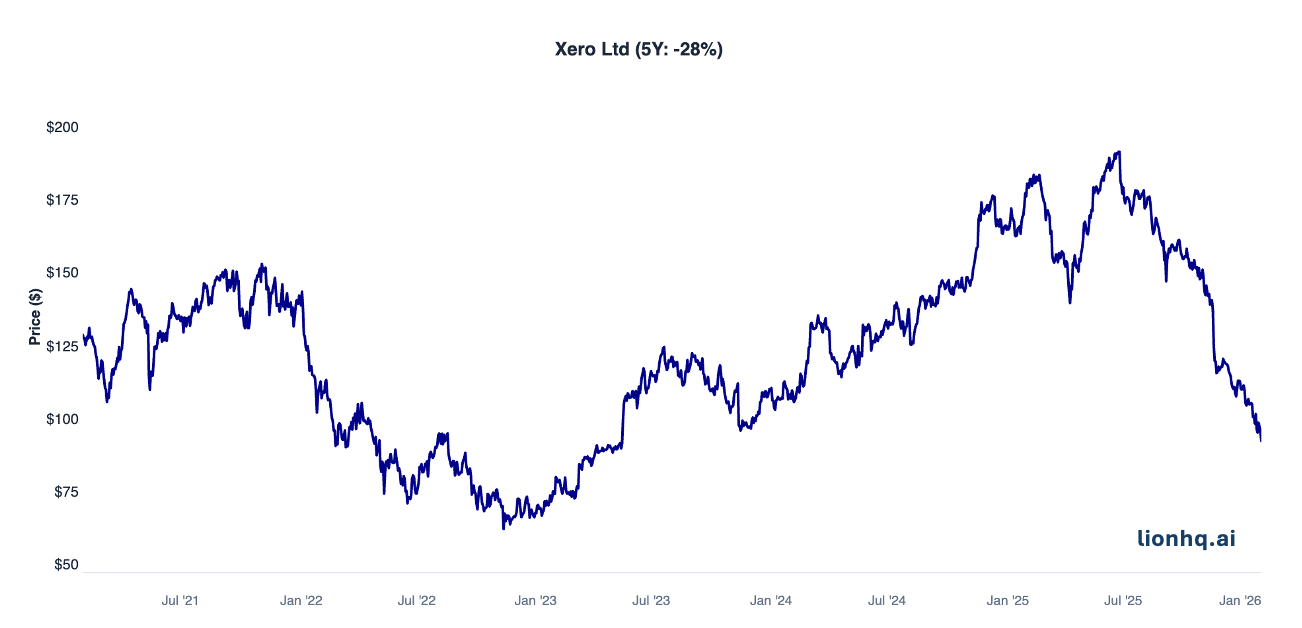

And in Australia, is Xero’s position really that secure? It’s a pretty clunky platform, and if someone said press this button to link your bank accounts, automatically categorize your data, learn from you dynamically, sort out your tax and present beautifully designed reports, I’d probably sign up.

Switching costs between platforms is also approaching zero.

This is all new territory, and there’s no choice if you’re in a knowledge industry but to engage and grapple with it full heartedly. The good news is it’s a lot of fun.

A small team of engineers used Claude Code to build Claude Work in less than two weeks, easily handling tasks that evaded decades of development at Microsoft, and the last three with their OpenAI partnership.

This really is a new stage in AI. It’s a very different beast now than the first three years after ChatGPT.

Every software company is now under pressure, but because things are moving so fast there’s greenfield opportunities everywhere, in industries that looked safely locked up by incumbents. This is the moment to seize. It’s safest in the barrel.

Healthcare Update

The more things change, the more things stay the same, and one sector that is somewhat independent of all these revolutions is healthcare, where the bottleneck remains the cost and difficulty of getting drugs working in humans.

Aussie biotech was a bit of a millstone last year. The data went mostly our way, with Syntara, Anteris, Clarity and Amplia all coming out with good news for patients.

But they are all more than 50% off their highs as enthusiasm was hit variously by FDA hiccups, and perhaps simply the cold hard reality of 3-5 year development timelines.

Syntara just announced a collaboration with the Garvan institute to study their drug in pancreatic cancer, a natural fit given the proven antifibrotic effect of their compounds.

The pattern is faily consistent - strong data excites the market, retail and institutional alike, only for that enthusiasum to wane in the face of launch dates stretching out to 2028-2030+.

There was some good news though. Anteris completed a US$320 million capital raise, including a $90 million investment from Medtronic.

This both solves their capital needs, funds their definitive head-to-head trial, and provides powerful validation of the platform from the second largest player. Medtronic is now a natural buyer, and while a competitive situation is less likely, it’s a relief to know that the most sophisticated in the business can see the potential that we see, especially as they have far more information than we do.

Our biggest successes were in revenue-generating US healthcare, where the technology is FDA approved and market validated, and we can ride both the roll-out of the treatment and the success of the pipeline. Generally, if something has worked in an initial condition, it will find success elsewhere, and with strong growing revenues, these companies have access to capital unavailable to pre-revenue biotech.

Grail

Grail is having its moment, and >$10b of investment (and growing), is finally coming to fruition. As a recap, their Galleri test detects over 50 types of cancer from a single blood draw, which identifies distinct methylation patterns on tumor-shed DNA, which is then crunched through machine learning models to identify the likely organ of origin.

This is relevant as 70% of cancer deaths come from cancers that aren’t screened at all: pancreatic, ovarian, liver, where symptoms often only appear in Stage IV. But there’s resistance from the medical community which rightly fears a wave of false positives.

Their largest US study, Pathfinder 2, showed Galleri detected seven times more cancers than conventional screening with a 62% positive predictive value, and a false positive rate of just 0.4%.

Revenue growth is solid at 29%, but the company really needs regulatory approval to win support from doctors.

Later this year we will see results from a 140,000 late stage study in the UK with the NHS, which will be the first randomized controlled study of this kind of testing. The company is funded, albeit heavily loss-making - but the opportunity is significant, certainly >US$20b in the mid-term with estimates as high as $100b+ in the long term. This compares well with both their current US$4 billion market cap, and recent acquisitions in the space (Exact Sciences was bought for $21 billion).

Day One Biopharmaceuticals posted $155 million revenue for 2025, and is guiding to over 50% growth next year. Regeneron, Castle Biosciences, and an old favourite, Twist, were also strong towards the end of the year.

There seems to be something of a sweet spot in healthcare right now: buying after both FDA approval and the initial launch/proof of traction, where the clinical risk is low and the company’s capital position is secure. Sometimes these companies are early on in their roll-out with multiple funded trials to expand the opportunity further.

This is broadly the profile we’re looking for in any new healthcare opportunities.

2026

This is going to be one of the strangest years. Knowledge work is being rapidly solved by computers, while the vast majority of people seem blissfully unaware.

A tiny portion of people are doing years of work in days while the vast majority are glued to their phones. So the cost of development is lower than ever, but it’s cheaper than ever to get a new product or marketing hook in front of millions of people, if only for a fleeting swipe-second.

Legacy software reminds me of Blackberry nearly 20 years ago, when it was clear Apple was cooler, better, and taking market share, but the company itself was doing fine, earnings were strong, and Blackberry was entrenched in the corporate world. Very similar to the position of some software companies today.

SAAS CEOs have done no favours to themselves by delaying profitability so long. There was a moment after 2022 where it seemed everyone was going to shift to GAAP profitability and cut stock-based compensation.

But the market bounce subsequently put an end to that, and now these companies are still losing money, right when growth is slowing down and it’s their turn to face major disruption.

Fortunately our own risk management software kept us out of the sector almost entirely, so this is something we’ve been able to watch from the sidelines.

And our process will generate structured entry points when inevitably the sell-off over shoots, and it becomes clear which of these companies are doing fine, handling the threat, and taking advantage of the new greenfield space.

Two things can be true at once - knowledge work has changed forever the last few weeks, and the sell-off will offer once-in-a-decade buying opportunities in the right companies.

For our fund, the same AI-generated software that kept us out of the sector in the sell-off will give us a structured entries into the companies that come out on the right side. But it seems, not quite yet.

Michael